Preparing for end-of-life may feel overwhelming and difficult to approach, yet it’s one of the most thoughtful gifts you can give to your loved ones. When affairs are in order, you provide your family with clarity, direction, and peace of mind during a time when they may need it the most. This guide offers an essential checklist to help you prepare, step by step, for the inevitable, in a way that feels manageable and empowering.

Why End-of-Life Preparation Matters

Taking time now to organize your affairs can save your family from legal complications, financial burdens, and confusion. By addressing these areas early, you can reduce stress and uncertainty for those closest to you, allowing them to focus on healing and remembrance. This guide covers essential legal and practical steps you can take, ensuring that your wishes are clearly documented and accessible.

Step 1: Organize Legal Documents

Create or Update Your Will

Your will is a foundational document in end-of-life and estate planning. It specifies how your assets will be distributed, who will manage your estate, and who will care for any dependents. If you don’t have a will, your assets may be distributed according to state laws, which may not align with your wishes. Consider working with an attorney to ensure your will meets all legal requirements and accurately reflects your intentions.

Read more here: Estate Planning vs. Will.

Establish Trusts if Necessary

Trusts can help simplify the transfer of assets by bypassing probate and potentially reducing estate taxes. They’re especially useful if you have considerable assets or complex estate plans. Common types include revocable living trusts, which can be modified during your lifetime, and irrevocable trusts, which cannot be changed after they are established but offer strong asset protection.

Assign Beneficiaries

Ensure that beneficiary information on financial accounts, retirement funds, and insurance policies is current. These designations often override instructions in a will, so keeping them up-to-date is essential for protecting your loved ones and honoring your intentions.

Step 2: Consider Health and Financial Powers of Attorney

Create a Durable Power of Attorney

A durable power of attorney allows you to assign someone to make financial decisions on your behalf if you are unable to do so. Without this in place, loved ones may need to seek court approval to manage your affairs, which can be a lengthy and stressful process.

Establish a Healthcare Power of Attorney

A healthcare power of attorney designates someone you trust to make medical decisions if you are unable to communicate. This person can ensure that your healthcare choices are respected and that your wishes guide any critical decisions. Discuss these preferences with your chosen representative to ensure clarity and confidence in your intentions.

For a detailed guide on creating advance directives, AARP provides helpful resources to guide you through the process. Access the AARP advance directives guide here.

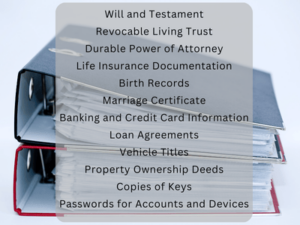

Step 3: Prepare an “In Case of Death” Binder or Folder

Compiling essential documents in one easily accessible location can save loved ones from searching through paperwork during a challenging time. Here’s what to include in your binder or folder:

- Legal Documents: Copies of your will, trusts, and power of attorney documents.

- Financial Information: Account numbers, bank statements, retirement accounts, and investment information.

- Insurance Policies: Include life insurance, health insurance, and other applicable policies.

- Contact List: Names and numbers for attorneys, financial advisors, and important contacts.

- Funeral Instructions: If you have specific wishes for your funeral or memorial, such as location, burial preferences, or religious considerations, document them here.

- For a comprehensive checklist of documents and steps for getting your affairs in order, refer to this NIA resource on orga

nizing your affairs.

Store this binder or folder in a safe place, such as a secure cabinet, and inform trusted family members or the executor of your estate about its location. Remember to update it periodically to reflect any changes in your circumstances or preferences.

For more on securing online accounts and digital assets, see our Ultimate Checklist for Securing Your Digital Legacy.

Step 4: Practical Steps for Your Loved Ones After Your Passing

Having a post-death checklist helps your family understand what to do first. While it’s difficult to cover every detail, here are some general actions that can make a difference during a difficult time:

1. Obtain Certified Copies of the Death Certificate

Certified death certificates are often required to settle an estate, access financial accounts, and handle insurance claims. Families usually obtain these through the funeral home or local government office.

2. Notify Important Parties

This includes employers, banks, insurance companies, Social Security, and any relevant governmental agencies. The sooner these organizations are notified, the quicker your family can manage benefits and accounts.

3. Begin the Probate Process if Applicable

If your estate requires probate, your designated executor will oversee this process. Probate is the legal procedure for distributing assets, handling debts, and closing accounts. It may feel complex, but your attorney can guide your executor through each necessary step, reducing the stress on your family. Avoid common issues with our guide on Common Delays During the Probate Process in Texas.

4. Manage Immediate Financial Obligations

Ensure that routine expenses (like mortgage, utility bills, or other ongoing payments) are handled promptly to avoid any disruptions.

Step 5: Long-Term Care and Medicaid Planning

For those concerned about potential long-term healthcare needs, including nursing home or assisted living costs, long-term care planning can be crucial. You may wish to look into:

- Medicaid Asset Protection Trusts: These trusts can protect assets while allowing you to qualify for Medicaid, if necessary.

- Long-Term Care Insurance: Policies can help cover healthcare costs in later life and prevent depletion of your savings.

Discuss these options with an attorney or financial advisor who specializes in elder law, as they can help you navigate the rules around asset protection, eligibility, and coverage.

For more on protecting assets from nursing home costs, see our post on What Happens to My Assets If I Go Into a Nursing Home.

Step 6: Communicate Your Wishes

Have Conversations with Your Family and Executor

While it may be uncomfortable, sharing your end-of-life wishes with loved ones can prevent misunderstandings later. Your family will have a clear understanding of your values and preferences, making it easier for them to honor your requests.

Read more from the conversation project about how to have these tough talks.

Document Wishes for Your Memorial

Beyond the legalities, you may have personal wishes for your memorial or funeral. Discussing your preferences openly can give your loved ones a chance to understand how you want to be remembered, which can be a meaningful form of connection.

Step 7: Grieving Support for Loved Ones

The passing of a family member is often a time of emotional upheaval. Leaving resources or suggestions for grief support can show compassion even after you’re gone. You might consider leaving a list of local support groups, counseling services, or spiritual resources. Small gestures like these can make a big difference in their healing process.

Common Questions and Concerns

“What happens if I don’t have a will or estate plan in place?”

Without a will or estate plan, your assets will be distributed according to state laws, which may not align with your personal preferences. This can lead to added expenses, delays, and potential disputes among family members. Having a plan in place ensures that your intentions are respected.

“How often should I update my estate plan?”

Review your estate plan every 3-5 years, or sooner if you experience significant life changes, such as marriage, divorce, the birth of a child, or substantial changes in assets. Regular updates keep your plans relevant and reflective of your current wishes.

“Is probate always necessary?”

Not necessarily. If you’ve set up a living trust or designated beneficiaries on certain accounts, those assets can transfer outside of probate. However, if you have a will or no estate plan, probate may be required to distribute your estate according to your wishes or state law.

Final Thoughts on End-of-Life Preparation

End-of-life planning is a deeply personal process, one that takes time, care, and the support of trusted professionals. By organizing your affairs, you offer a final act of love and protection for your family. They will have the security of knowing your wishes and the guidance to carry them out, helping them navigate their way through a difficult time with confidence and peace.

If you’d like to discuss how Hailey-Petty Law Firm can assist in creating a personalized end-of-life plan, we invite you to reach out for a consultation. Our goal is to provide you with compassionate guidance and clear answers so that you and your loved ones feel prepared for the future.