Last Updated on February 4, 2025

If you’ve ever found yourself wondering whether you need a will or a full estate plan to protect your family and your assets, you’re not alone. It’s one of the most common questions people have when thinking about estate planning vs will. The truth is, both wills and estate plans serve vital purposes, but they aren’t the same thing. Depending on your unique situation, one might be far more beneficial to you and your family.

In this no-nonsense guide, we’ll break down the differences between estate planning vs wills in a way that’s easy to understand. By the end, you’ll have the clarity you need to decide which option is best for your future—and most importantly, how to secure your family’s future.

What is a Will?

Let’s start with the basics. A will is a legal document that spells out how your assets should be distributed after you pass away. It allows you to name beneficiaries who will inherit your property and can also designate guardians for any minor children you may have. If you have any specific wishes regarding who gets what, a will is where you’ll outline those instructions.

Let’s start with the basics. A will is a legal document that spells out how your assets should be distributed after you pass away. It allows you to name beneficiaries who will inherit your property and can also designate guardians for any minor children you may have. If you have any specific wishes regarding who gets what, a will is where you’ll outline those instructions.

It’s important to know that a will only goes into effect after you die. This means that if you become incapacitated or unable to manage your affairs while you’re still alive, your will doesn’t offer any help. That’s where more comprehensive estate planning comes in—but we’ll get to that in a minute.

Key Features of a Will:

- Names an Executor: The person you appoint to carry out your instructions and oversee the distribution of your assets.

- Designates Beneficiaries: You decide who will receive your property, whether it’s family members, friends, or charities.

- Appoints Guardians for Minor Children: If you have young children, your will can name someone to take care of them if something happens to you.

While a will is an essential part of any plan, it has its limitations. One major drawback is that wills must go through probate, a legal process that can be time-consuming, expensive, and, frankly, a hassle for your loved ones.

What is Estate Planning?

When we talk about estate planning, we’re referring to a more comprehensive approach to managing your assets—both during your life and after you’re gone. Think of estate planning as an umbrella that covers several key legal documents and strategies, one of which is your will. But it also includes tools like trusts, healthcare directives, and powers of attorney, which allow you to plan for things that could happen while you’re still alive, such as illness or incapacity.

When we talk about estate planning, we’re referring to a more comprehensive approach to managing your assets—both during your life and after you’re gone. Think of estate planning as an umbrella that covers several key legal documents and strategies, one of which is your will. But it also includes tools like trusts, healthcare directives, and powers of attorney, which allow you to plan for things that could happen while you’re still alive, such as illness or incapacity.

An estate plan offers a more robust way to protect your assets, reduce the risk of probate, and ensure that your loved ones are taken care of according to your wishes. This approach is particularly important if you have a complex financial situation, own property, or want to protect your assets from creditors or legal disputes.

Key Features of Estate Planning:

- Avoids Probate: Assets held in a trust bypass the probate process, saving your family time and money.

- Incapacity Planning: By including documents like a living trust and healthcare directives, you can plan for what happens if you’re unable to manage your affairs due to illness or injury.

- Flexibility in Asset Distribution: Estate planning allows you to control how and when your assets are distributed. For example, you can specify that your children receive their inheritance at a certain age or under certain conditions.

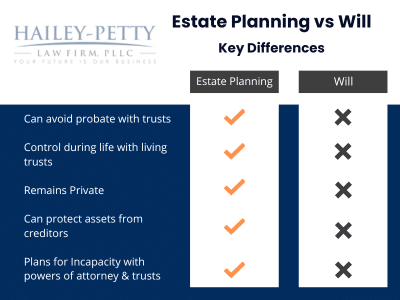

Estate Planning vs. Will – What’s the Difference

Probate

A will must go through probate, which is the court-supervised process of proving that your will is valid and distributing your assets accordingly. Probate can take months—or even years in some cases—and it often comes with legal fees and court costs that eat into the value of your estate.

Estate planning, on the other hand, offers ways to avoid probate altogether. By using a living trust, for example, your assets can be transferred directly to your beneficiaries without ever having to go through probate. This keeps the process private and much quicker.

Control During Your Lifetime

One of the biggest limitations of a will is that it only takes effect after you die. If you become incapacitated, the court may have to appoint a guardian or conservator to manage your affairs. But with estate planning, you can avoid that scenario by including a durable power of attorney and a living trust in your plan. These documents allow someone you trust to step in and manage your financial or medical decisions if you’re unable to do so.

In short, estate planning gives you control over your assets and your healthcare decisions while you’re alive—a will does not.

Privacy

When a will goes through probate, it becomes a matter of public record. Anyone can access the details of your will, including the value of your estate and who’s getting what. Estate planning, particularly when you use trusts, keeps these details private. If maintaining your family’s privacy is important to you, a trust is a better option.

Asset Protection

If you’re concerned about protecting your assets from creditors, lawsuits, or even Medicaid recovery, estate planning can offer solutions that a will alone cannot. Certain types of trusts, like an irrevocable trust, can shield your assets from being claimed by creditors or other legal claims, ensuring that more of your wealth goes to your loved ones.

A will doesn’t offer any protection against these risks. Once your assets go through probate, they could be exposed to claims from creditors or lawsuits. For more information on estate and gift taxes, see the IRS guidelines here.

Common Myths About Wills and Estate Planning

Let’s take a moment to clear up some common myths that often come up when people think about estate planning vs wills.

Myth 1: “A Will Is All You Need”

Many people assume that as long as they have a will, they’re all set. While a will is certainly important, it’s not a catch-all solution. A will alone doesn’t protect you during your lifetime, and it won’t shield your assets from probate or creditors.

Myth 2: “Estate Planning Is Only for the Wealthy”

This myth keeps a lot of people from taking steps to protect their assets. Estate planning isn’t just for the ultra-wealthy—it’s for anyone who has assets they want to protect. Even if you have a modest estate, estate planning tools like trusts and powers of attorney can save your family from unnecessary stress and costs down the road.

Myth 3: “You Don’t Need Estate Planning if You Have a Simple Estate”

Even simple estates can benefit from estate planning. For example, if you own a home or have savings, a living trust can help your beneficiaries avoid probate. And let’s not forget the importance of incapacity planning—whether your estate is simple or complex, you’ll want someone you trust to manage your affairs if you become unable to do so.

Which Option Is Right for You?

When a Will Might Be Enough:

- You have a small estate with few assets.

- You don’t have minor children or other dependents.

- You aren’t concerned about probate, privacy, or asset protection.

In these cases, a simple will might be sufficient to distribute your assets and name a guardian for any dependents.

When Estate Planning Is the Better Option:

- You want to avoid probate and keep the distribution of your assets private.

- You have minor children or dependents with special needs.

- You own property, have investments, or have a more complex financial situation.

- You want to plan for incapacity and ensure your healthcare and financial decisions are managed by someone you trust if you’re unable to do so.

If any of these situations sound familiar, estate planning is likely the better route to take.

For an even deeper dive into when a trust is a better choice than a will, you can read more in these blog posts:

- Trust vs. Will | Who Needs A Trust Instead of a Will?

- Is a Trust Better Than a Will? | Texas Wills and Trusts Lawyer

Why You Shouldn’t Wait:

Here’s the thing: estate planning isn’t something you want to put off. Life is unpredictable, and the earlier you put your plans in place, the better. Waiting until a crisis happens—whether it’s a sudden illness or an unexpected death—can lead to rushed decisions, legal battles, and financial strain on your family.

By planning early, you can rest easy knowing that your wishes will be honored and your loved ones will be taken care of, no matter what.

Take Control of Your Future: Choose the Plan That Protects What Matters Most

In the end, both wills and estate planning serve important roles, but one may be more suited to your situation than the other. A will can help ensure your assets are distributed after your death, but it may not offer the comprehensive protection your family needs. Estate planning, on the other hand, can provide peace of mind during your lifetime and safeguard your legacy for future generations.

If you’re unsure which option is best for you, don’t hesitate to reach out to us at Hailey-Petty Law Firm. We offer a free consultation to walk you through your options and help you make the right decision for your family’s future. Let’s secure your peace of mind—starting today.